Engaged in the clothing industry for 20 years.

Nona Source: Why the success of its business model favours a new circular model

Nona Source, the platform specialising in the marketing of deadstock materials from fashion houses, has introduced a solid business model. In a sector that is still poorly mastered eco-circularity, Nona Source pays particular attention to remaining economically balanced, while retaining awareness of the other factors that need to be taken into consideration. In this way, it is proving that creative circularity is not a burden for companies, but rather an essential driver of tomorrow’s production model. In other words, by favouring production based on available resources, Nona’s eco-circular model proposes putting an end to the linear model that has long dominated industry.

At the root of Nona Source’s vision is youth and innovation. Working at LVMH as a buyer and quality manager, Romain Brabo witnessed the challenge faced by all fashion houses around the world: accumulating stocks of materials at the end of each season. At the same time, he noticed that the young designers around him were constantly on the lookout for quality materials. The observation was (almost) simple: resources seen as waste by some, were seen as coveted and inaccessible raw materials by others. But somehow, these two worlds cannot meet.

These premium materials are effectively often out of reach for young designers, not least because of the minimum order requirements – the infamous MOQs (Minimum Order of Quantity) – imposed by suppliers. It was against this backdrop that Brabo created Nona Source. A solution that not only enables the major fashion houses to clear their inventories to accommodate new collections, but also supports the creative community and emerging brands by offering them materials of great intrinsic value.

“When it comes to the circular economy today, the main issue is not to lose money. That’s what I’ve been promoting since day one: showing that we’re virtuous because we’re not losing money,”

Nona Source: Achieving ‘product-market fit’ in eco-circularity

These few elements show that the strength of the Nona Source business model is largely based on a “product-market fit”, i.e. a perfect match with market needs from the outset. The platform meets a concrete and real need in the industry. However, to ensure the sustainability of this service, it had to be accompanied by a solid and coherent business model. To get an idea, we started by asking Brabo about what he sees as the strengths of the Nona Source model. “Nona Source’s business model has been carefully thought through. We’ve had just one watchword from day one: don’t lose money. In fact, since we launched we’ve broken even,” he began.

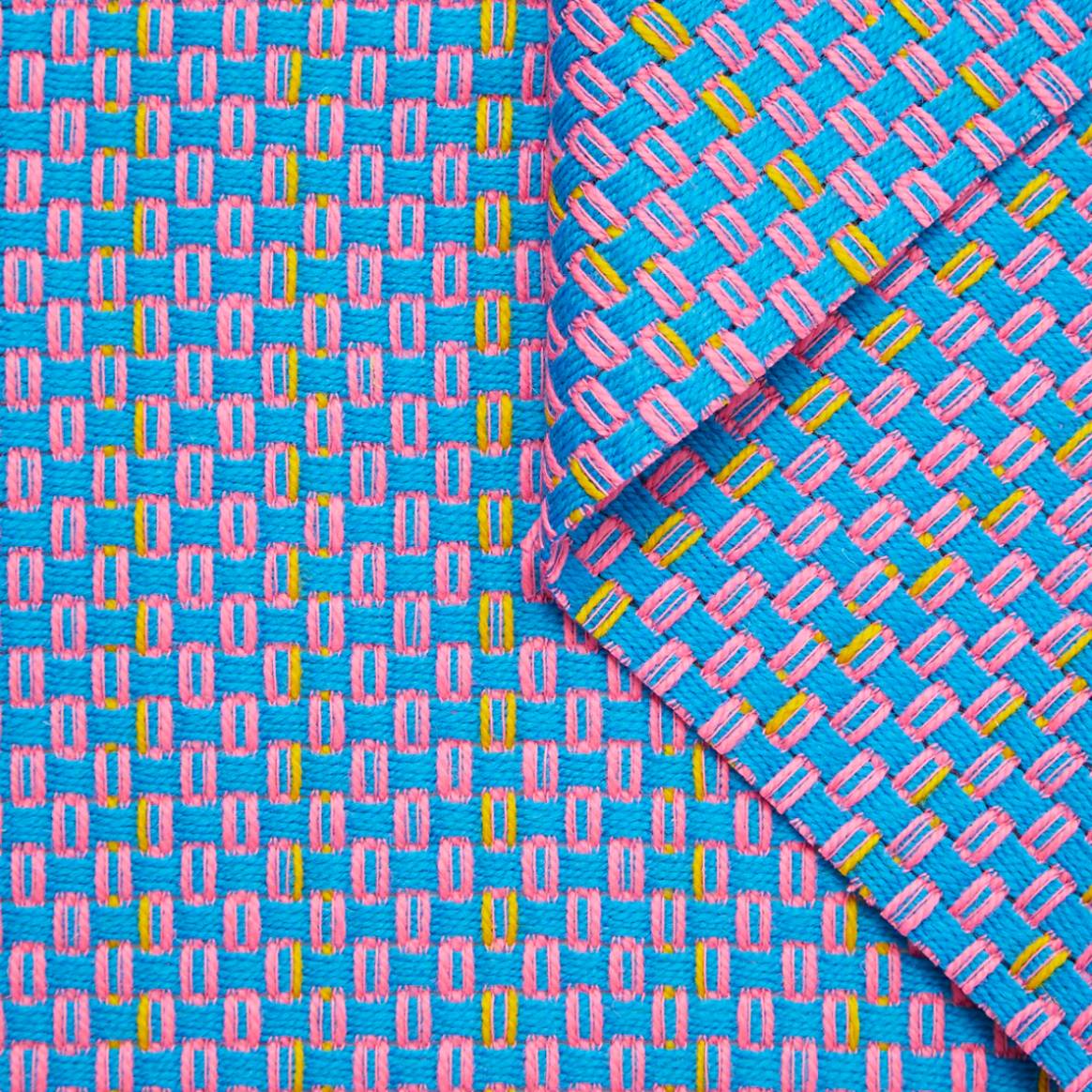

The model draws its strength mainly from its partners and end customers. Nona Source currently works with 17 fashion houses, each with their own identity. This diversity of profiles translates into a wide variety of offers and products, with no fewer than 4,000 references available for sale. The other major advantage of using dormant stocks is that they can offer designers immediate access to premium materials, with no production delays. This “stocks on demand” approach, recommended by industry experts, means that demand can be met without generating unnecessary surpluses or waste. It is a simple, yet innovative process: producing to meet demand, rather than flooding the market with unsold materials, clogging up warehouses and swelling the ranks of our waste production.

Another interesting point is that, in response to the problem of minimum purchase quantities, Nona Source has opted to sell by the roll, which allows brands to purchase smaller quantities to create their collections. This is an undeniable advantage for brands, which can then design exclusive, limited, circular microcapsule collections made from the highest quality materials on the market. In addition, Nona Source favours a local approach: all its partners and stocks are based in France. Meaning that all the brands that source from them can defend a local positioning while benefiting from the direct transmission of know-how from the haute couture houses.

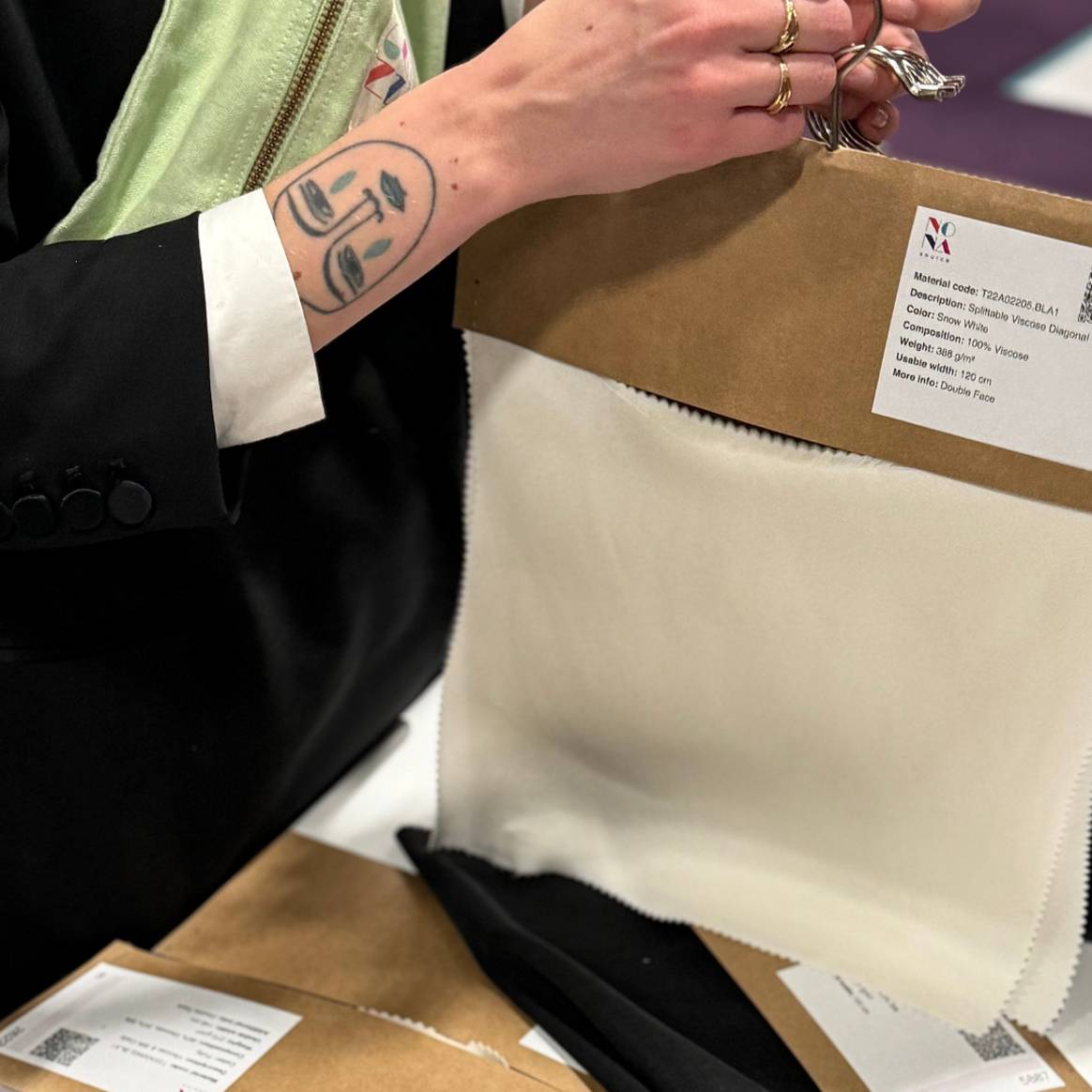

The Nona Source model relies on a final key asset: in-depth knowledge of materials, textiles, product manufacturing and industry. The platform was designed by and for design professionals, in collaboration with a number of experts from LVMH. An undeniable advantage over the competition. It is also an expertise that has enabled Nona Source to revise its primary ambition to be an entirely digital platform in good time. Its experts know that the tactile perception and feel of the drape of materials are essential elements for designers, which are difficult to reproduce online. At least for the moment. That is why, as well as viewing and ordering products online, designers can come and get inspired through consultations with the materials in the Nona Source showroom at La Caserne, a sustainable fashion hub in Paris.

“In the past, the dominant model was ‘I have an idea, I order, I have it produced’, but today it has evolved towards ‘I adapt to the resources available and I create according to what I have on hand in terms of quantity and references’,”

Nona Source’s financial balance: Between autonomy and LVMH support

Following on from the prior mention of innovation, it must be noted that Nona Source is the result of an intrapreneurial project, one that received acclaim at the LVMH Open Innovation. Three years after its launch and after securing victory in this competition combining intrapreneurship, innovation and technology, we can legitimately wonder whether there will be any question of external funding for this project in the future. And whether the aim of this project, which is internal to the group, is in fact to be profitable. Brabo noted: “When it comes to the circular economy today, the main issue is not to lose money. That’s what I’ve been promoting from day one: showing that we’re virtuous because we’re not losing money.”

This is also what LVMH imposes on them, to show the industry that circularity is not a cost centre. That you do not necessarily have to seek growth at any price, but that sometimes you have to know how to stay balanced. In this respect, are they breaking even precisely because they have benefited from financing from LVMH? “It would be easy to say that,” replied Brabo. “Nona Source is a platform that lives by itself. Initially, LVMH bought stock, but this was re-invoiced to Nona Source. Nona Source has no support to live on. LVMH’s contribution is mainly from a mentoring point of view. Antonio Belloni, managing director of the group and chairman of Nona Source, is supporting us with his business expertise and business legislation. Hélène Valade, the LVMH Group’s environment director, supports us on all environmental issues. The group’s press relations department also helps us to communicate the image of Nona Source.”

Behind this business model are Marie Falguera, Anne Prieur du Perray and Brabo, himself, who graduated from business school with a specialisation in entrepreneurship. This background enabled him to effectively defend the project internally, rally stakeholders to release the first budgets and attract investors. This was a key element in their start-up. Then everything accelerated very quickly with the support of LVMH, the enthusiasm of the major houses and the arrival of key players from Nona who joined the adventure.

Opportunities to improve Nona Source: A look at the platform’s challenges

Although Nona has many strengths, a few weaknesses remain. Nona Source is a new and evolving platform offering an emerging service in a nascent sector. Just by observing how the terms ‘circularity’ or ‘upcycling’ are misused and thrown around, one can understand that there is still a long way to go before witnessing the mainstream adoption of these services. One of Nona’s model weaknesses is actually a breach in one of its strengths: selling by the roll. It limits its ability to offer a ‘cut’ model to designers – i.e. custom cuts – a choice that Brabo knows will eventually end up being ‘business killing’, but which for the time is perfectly deliberate and desirable if they want to maintain such competitive prices. In fact, it is perhaps these prices that are stimulating the ever-growing B2C demand that Nona is receiving. But whatever the case, the platform is maintaining its commitment to catering exclusively for professionals. “Above all, we want to help professionals change the way they source and make products,” said Brabo.

Another point of reflection concerns the limitation of its offer, another chink in the solidity of its strategy. Not only is it limited in time, but also in space. Its catalogue depends entirely on the stocks of its partner fashion houses. As a result, a designer wishing to create a specific collection will be limited by the availability of materials on the platform, either in the volume of a chosen material, or in the range available. If they want a bright red in a certain silk, or to create 500 dresses with a given material, for example, they will have to make do with the red and the volume available at the precise moment at Nona Source.

Nona Source had also focused on a very local issue – that of France. This was largely as the company did not want to send materials by plane to the other side of the world, which is commendable and consistent. Yet, one could point out that Nona could have very well replicated its model abroad. “Absolutely,” said Brabo, who admitted that he is “open to international projects”, but only for boat deliveries. “We’ve thought several times about replicating the solution locally in the US, or on another continent. But today we’re at a level of maturity that suggests there’s still a lot to be done in Europe and in France, Italy and Spain. We’re at the beginning of the history of circular creativity. There’s still a lot to do before the model is mature enough to be exported,” explained Brabo, before specifying that he would aim for this goal “within the next five to ten years”.

Nona Source’s ambitions for the next five to ten years

So, what is it exactly that Nona intends to do in these “next five to ten years”? Among the prospects and opportunities envisaged by the firm are answers to the following mission: offering designers materials that are high quality, innovative and environmentally-friendly. However, meeting these three criteria is currently a major challenge. Brabo sees huge potential for growth in this area and views Nona Source as a benchmark for the fashion and design sector in meeting all three criteria. What is more, for designers, using these surplus stocks not only reduces their carbon footprint, it also forces them to adopt a circular rather than linear approach to their creative process.

“What satisfies me most is the trust that LVMH has placed in me by allowing me to develop this business,”

“In the past, the dominant model was ‘I have an idea, I order, I have it produced’, but today it has evolved towards ‘I adapt to the resources available and I create according to what I have on hand in terms of quantity and references’,” explained Brabo. And Nona Source is positioned to support these new modes of creation. These more linear models still prevail with some of the major players, particularly mass-producing groups. Nona’s limited resources prevent it from working with these mass-market channels. Yet, Nona believes it has a role to play in supplying materials that promote high-quality, environmentally-friendly design – materials that inspire the creatives at the big houses, that meet very strict specifications on ESG criteria in particular, and that offer real long-term sustainability.

Nona’s growth prospects: An overview of the deadstock market

Nona currently works with 2,500 young, emerging and more or less established brands in France and Europe. A field of end customers that could be much wider. “Indeed, the whole industry is impacted by deadstocks. It is very difficult to get data. Many consultancies have looked into these issues, but to no avail. However, within luxury goods companies, it is estimated that between 5 and 10 percent of all materials purchased correspond to deadstock. In mass distribution, the figure is closer to 15 to 20 percent. It is therefore a subject which is not neutral. Today, Europe is in the process of deciding on an average, which would be 15 percent of dead stocks of materials. The potential for development is therefore significant,”Brabo explained.

At the moment, Nona has chosen to concentrate on materials that meet very strict specifications, and is focusing on luxury homes. When we asked Brabo how they intend to address the issue of volume in deadstock, he told us that they can partly be addressed by the recycling sector, since volumes can be higher. On the other hand, there is a quality issue. At present, recycling procedures are not mature enough to meet the exacting specifications of fashion houses. “Because it is not virgin fibre, it is recycled fibre. It’s much more fragile,” explained Brabo.

The challenge is therefore to work in partnership with recycling platforms such as WeTurn, to help luxury houses incorporate recycled materials into their collections. Nona has made a name for itself in this niche sector, supporting emerging brands. “Our aim is to promote new creative models and challenge new designers arriving on the market, by saying to them, ‘Isn’t the creative challenge of tomorrow to know how to create from what already exists? The closeness between Nona and the creative community, the excellence and the know-how that is upheld in everything the group does, from receiving customers to delivering products, has been felt by customers,” said Brabo.

To conclude, we asked Brabo what he likes best about this intrapreneurial adventure. “As the head of Nona source, what satisfies me most is the trust that LVMH has placed in me by allowing me to develop this business. I do not necessarily correspond to the standards of a manager within a group, and the fact that they let me defend my convictions is very gratifying on a personal level,” he commented.

Our final question revolved around his view of the eco-circularity market. Brabo responded: “We are still in the early stages of this market, and it is very complex. There are many working groups with the new players in the circular sector, whether in reuse, recycling, upcycling or remanufacturing. We are all in the process of reframing definitions, because we realise that everyone is using words all over the place, and not to define the same methods. We are witnessing the emergence of new economic models that need to find their financial stability. Some solutions may also be more expensive. It is a real challenge, but it is also the advent of a new model that we are defending with Nona Source. We are seeing more and more competitors, which is exciting because it means there is a demand. The more of us there are, the stronger and more collaborative we are, and the better we can steer the fashion industry towards its new horizons.”